idaho sales tax rate lookup

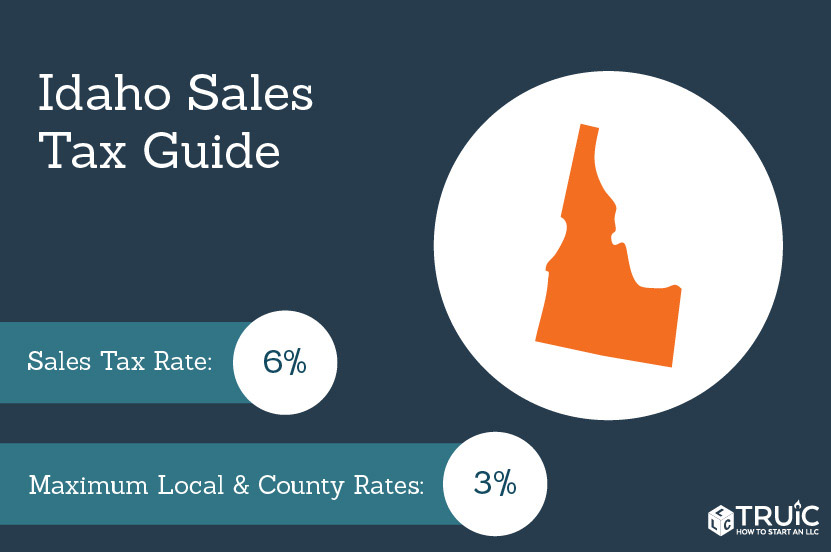

The Idaho sales tax rate is 60. Local tax rates in Idaho range from 0 to 3 making the sales tax range in Idaho 6 to 9.

Kootenai County Property Tax Rates Kootenai County Id

Maximum Local Sales Tax.

. Average Local State Sales Tax. The minimum combined 2022 sales tax rate for Idaho Falls Idaho is. If you need access to a database of all Idaho local sales tax rates visit the sales tax data page.

Local level non-property taxes are allowed within resort cities if. Exact tax amount may vary for different items. Most homes farms and businesses are.

The sales tax rate in the state is 6 percent which ranks Idaho as 17th on the list of 50 states with the highest sales tax. Find your Idaho combined state and local tax rate. Use this search tool to look up sales tax rates for any location in Washington.

Non-property taxes are permitted at the local. Depending on local municipalities the total tax rate can be as high as 9. Idaho has a 6 statewide sales tax rate but also has 116 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0074 on top.

The Idaho ID state sales tax rate is currently 6. Quickly learn licenses that your business needs and. This is the total of state county and city sales tax rates.

ZIP--ZIP code is required but the 4 is optional. What is the sales tax rate in Idaho Falls Idaho. The Idaho State Idaho sales tax is 600 the same as the Idaho state sales tax.

The Idaho state sales tax rate is 6 and the average ID sales tax after local surtaxes is 601. Idaho sales tax rate Sales tax rate. The current state sales tax rate in Idaho ID is 6.

There are a total of 116 local tax jurisdictions across the. 2022 Idaho state sales tax. With local taxes the total.

Get information about sales tax and how it impacts your existing business processes. Sales tax rates in Idaho are destination-based meaning the sales tax rate is based or. Some but not all choose to limit the local sales tax to lodging alcohol.

Also the Idaho State Tax Commission sets property tax values for operating property which consists mainly of public utilities and railroads. No other municipality can add sales taxes on top of the state rate. Resort cities have a choice in whats taxed and can include everything thats subject to the state sales tax.

The base state sales tax rate in Idaho is 6. Maximum Possible Sales Tax. Municipal governments in Idaho are also allowed to collect a local-option sales tax that ranges from 0.

While many other states allow counties and other localities to collect a local option sales tax Idaho does not. If the tax rate search. Idaho has a statewide sales tax rate of 6 which has been in place since 1965.

31 rows The state sales tax rate in Idaho is 6000. The total tax rate might be as high as 9 depending on local municipalities. Apply more accurate rates to sales tax returns.

280 rows 6074 Idaho has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 3.

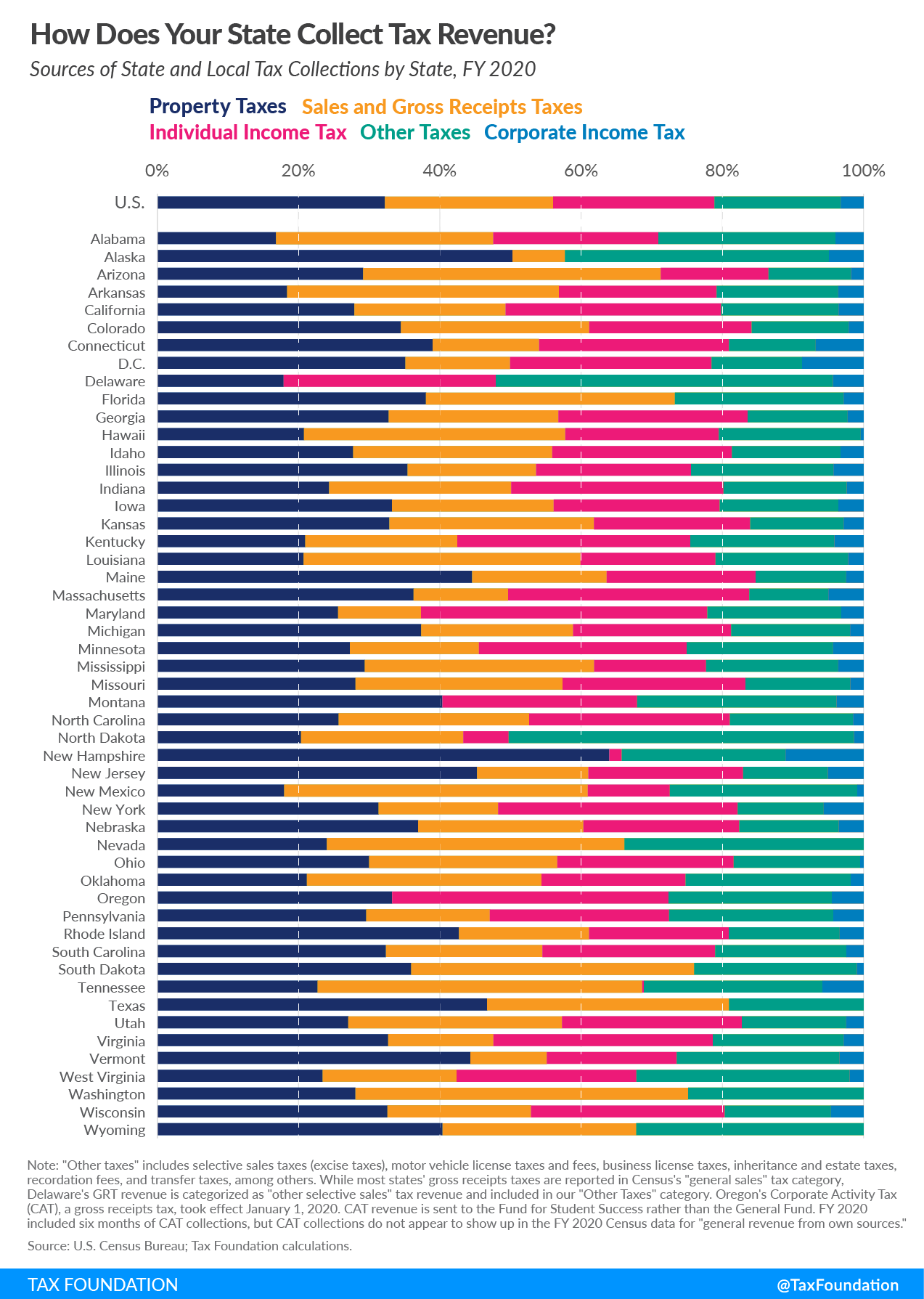

New York Tax Rates Rankings New York State Taxes Tax Foundation

Idaho 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Idaho Sales Tax Exemption Form St 133 Fill Out And Sign Printable Pdf Template Signnow

Idaho Sales Tax Rates By City County 2022

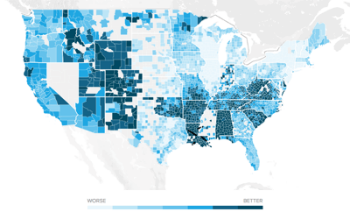

Property Tax Calculator Estimator For Real Estate And Homes

Idaho Property Taxes Everything You Need To Know

Sales Tax Calculator And Rate Lookup Tool Avalara

Idaho Sales Tax Small Business Guide Truic

Los Angeles Sales Tax Rate And Calculator 2021 Wise

Treasure Valley Subaru Subaru Dealership In Nampa Id

Sales Taxes In The United States Wikipedia

Tobacco Cigarette Tax By State 2022 Current Rates In Your Jurisdiction

Sales Use Tax South Dakota Department Of Revenue

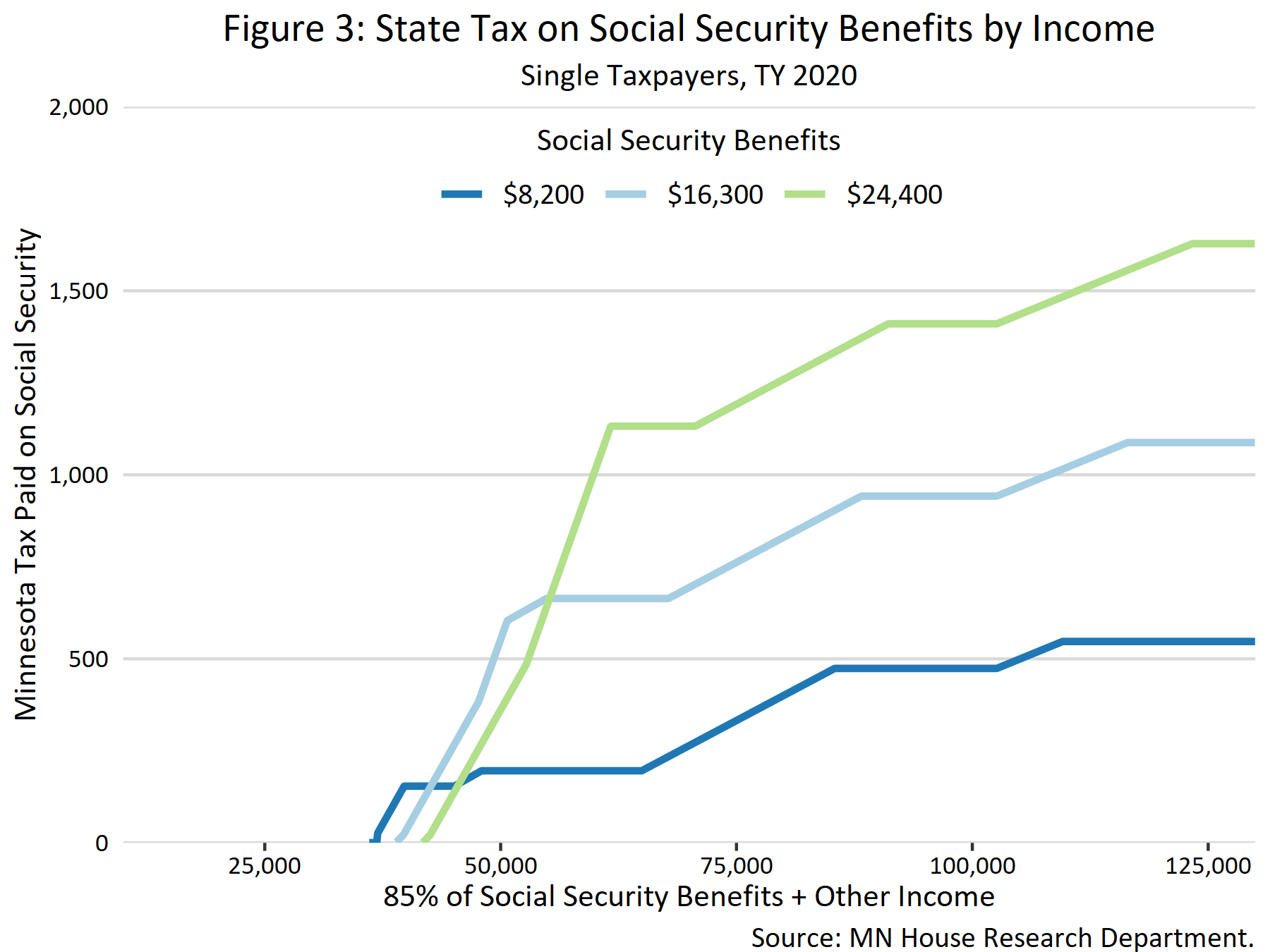

Taxation Of Social Security Benefits Mn House Research

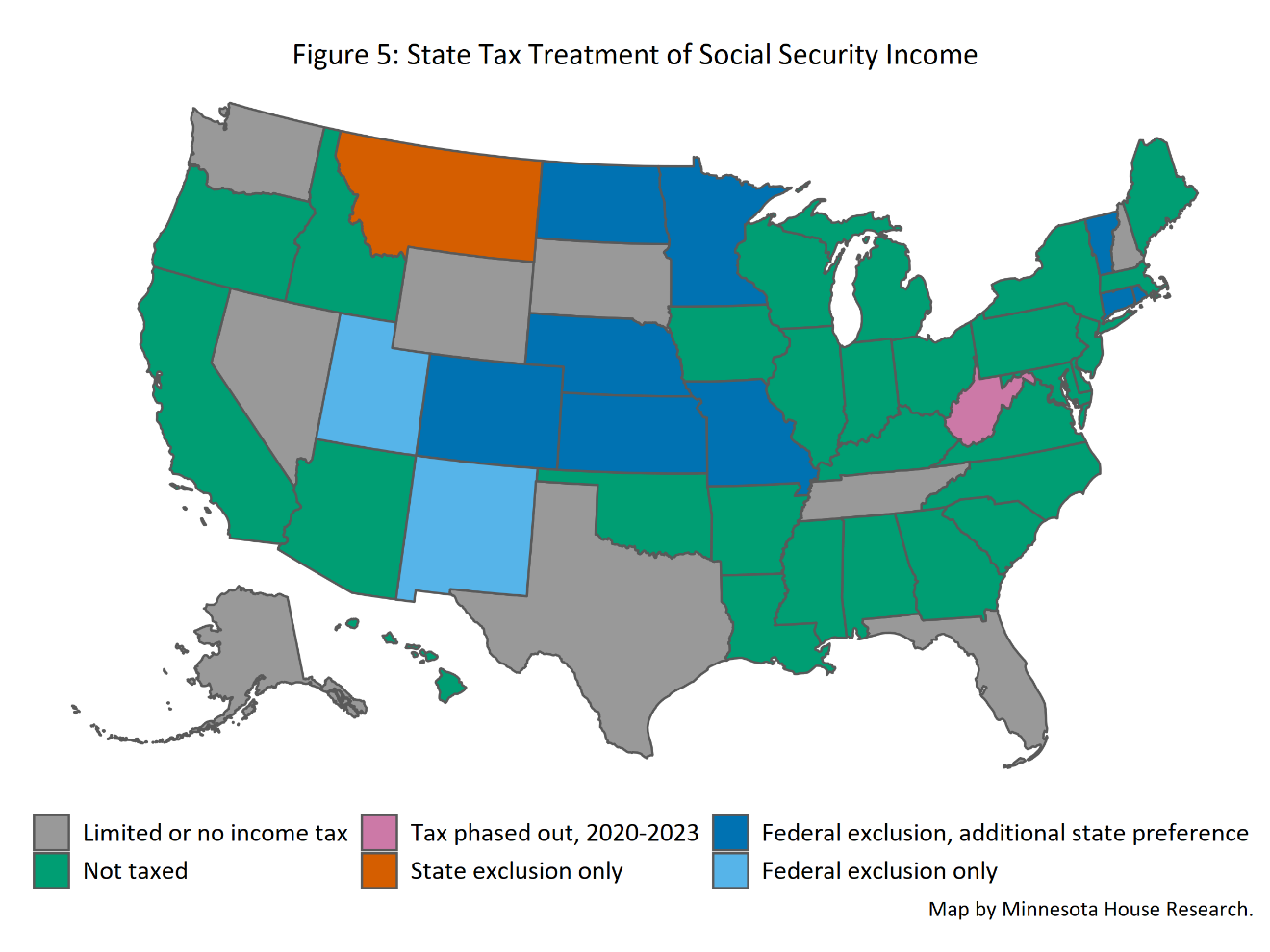

Taxation Of Social Security Benefits Mn House Research

Costco Sales Tax By State Check Sales Tax